Search Impression Share: A Google Ads Bidding Formula for Mid-Market ROI

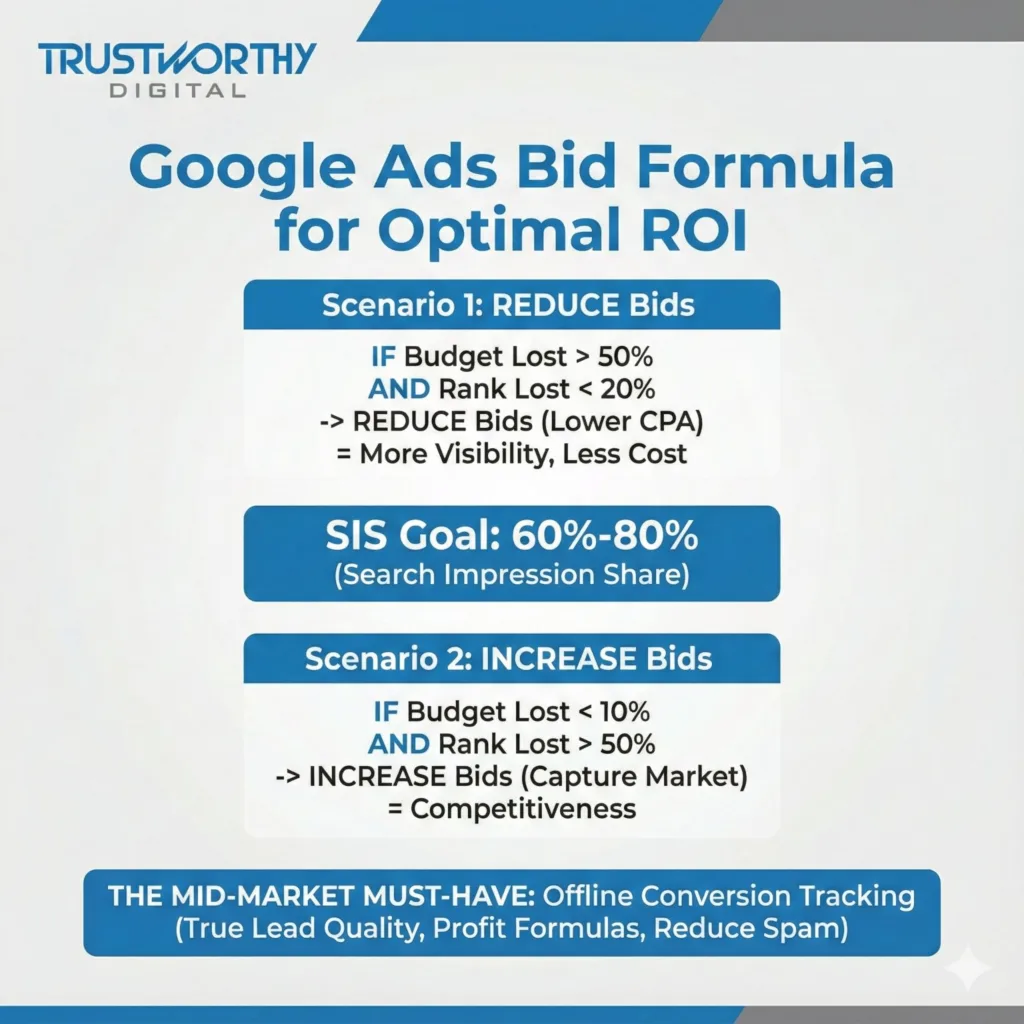

Bid decisions based on CPC or cost per lead are how mid-market budgets get wasted. The signal that tells you when to raise or lower bids is Search Impression Share, specifically when you read Search Lost to Budget and Search Lost to Rank together.

In this article, we break down the Google Ads bidding strategies we use at Trustworthy Digital that give you a repeatable decision framework to improve ROI without guessing. Search Impression Share tells you what’s limiting reach, not whether more reach is profitable. Profitability should be confirmed with offline conversion data.

Key Takeaways

- Search Impression Share is the best delivery constraint signal – Unlike CPA or cost per lead, SIS shows whether budget or rank is limiting visibility before clicks ever happen, making it essential for bid decisions.

- A good Search Impression Share falls between 60% and 80% – This range captures high-intent demand efficiently without overspending on low-quality impressions or diminishing returns.

- Search Lost to Budget > 50% = reduce bids – Your bids are outpacing your budget, causing ads to stop showing too early in the day and limiting total impressions you could afford.

- Search Lost to Rank > 50% = increase bids – Competitors are winning auctions you have budget to compete in, and raising bids helps reclaim lost Search Impression Share.

- Offline conversion tracking makes the bidding formula profitable – By optimizing for closed deals instead of form fills, bid changes are tied to revenue, not just lead volume.

What is Search Impression Share?

Search Impression Share is a Google Ads metric that shows the percentage of eligible impressions your ads actually receive. In simple terms, it measures how often your ads appear when someone searches for keywords you’re targeting.

Unlike post-click metrics like cost per lead or CPA, Search Impression Share is a pre-click visibility metric. It tells you whether your ads are showing consistently, or whether budget limits or auction competitiveness are preventing them from appearing.

Search Impression Share is calculated automatically by Google using this formula:

Impressions received ÷ total eligible impressions

To understand why impressions are being missed, Google breaks Search Impression Share into two critical components:

- Search Lost to Budget – Your ads stopped showing because your daily budget was exhausted.

- Search Lost to Rank – Your bids or quality score weren’t competitive enough to win the auction.

Reading these two metrics together reveals whether you need to lower bids, increase bids, or adjust budgets, which is why Search Impression Share is the foundation of our Google Ads bidding formula.

The 60% to 80% Search Impression Share Sweet Spot

This framework shows what a good Search Impression Share looks like and how to adjust bids based on whether your account is limited by budget or auction competitiveness.

The optimal Search Impression Share range for most mid-market Google Ads accounts falls between 60% and 80%. We see diminishing returns above this range in many accounts: the cost to capture the next increment of impression share rises faster than the incremental qualified revenue it produces.

For many mid-market, non-brand, high-intent search campaigns, 60% to 80% is often an efficient coverage range. Brand campaigns, highly competitive categories, and limited-capacity businesses may need different targets:

- Brand defense campaigns often aim higher, sometimes 90%+

- Very competitive non-brand campaigns may find profitable coverage at lower levels

- Capacity-constrained businesses may intentionally cap volume below this range

Pushing toward 100% Search Impression Share usually means bidding aggressively on every possible query variation, including broader, lower-intent searches that inflate costs and reduce ROI.

Staying below 50% Search Impression Share often means leaving meaningful demand on the table, allowing competitors to capture searches from prospects actively looking for your solution.

Scenario 1: When You Should Reduce Google Ads Bids

Conditions That Signal Over-Bidding

- Search Lost to Budget > 50%

- Search Lost to Rank < 20%

What This Means for Your Account

Your bids are competitive enough to win auctions, but they’re exhausting your daily budget too quickly. You’re running out of money before running out of search demand.

As a result, you’re missing impressions you could afford if your cost per click were lower. The budget constraint isn’t real demand; it’s created by bids that are higher than necessary to maintain visibility.

The Correct Action to Take

Lower bids, or tighten your automated bidding targets so the system bids more efficiently. This reduces CPC, keeps you showing throughout the day, and helps you capture additional impressions your budget can actually support.

High Search Lost to Budget does not automatically mean bids are too high. If closed-won ROI is strong and you want more volume, increasing the budget can be the correct move. Raise or lower bids only after you confirm that the extra impression share produces a qualified pipeline, not just cheaper leads.

Scenario 2: When You Should Increase Google Ads Bids

Conditions That Signal Under-Bidding

- Search Lost to Budget < 10%

- Search Lost to Rank > 50%

What This Means for Your Account

You have a budget sitting unused while competitors win the auctions you’re losing. More than half your missed impressions are due to insufficient bids, not budget exhaustion.

Your ads aren’t competitive enough to show up when prospects search, and paid social ads competitor analysis can help you understand where your rivals are capturing attention. That idle budget represents lost market share going to other advertisers.

The Correct Action to Take

Increase bids, or loosen your automated bidding targets so you can compete in auctions you’re currently losing. This puts your existing budget to work instead of leaving demand on the table and helps you reclaim visibility for searches already happening in your market.

Search Lost to Rank can also be reduced by improving Ad Rank through better ads, landing pages, and tighter keyword-to-ad alignment. Raise bids only after you confirm that the extra impression share produces a qualified pipeline, not just higher volume.

Scenario 3: When Budget and Rank Are Both Limiting You

Conditions That Signal Targeting or Quality Issues

- Search Lost to Budget > 50%

- Search Lost to Rank > 50%

What This Means for Your Account

You’re both budget-constrained and uncompetitive in auctions. This usually signals targeting that’s too broad or campaigns with low Quality Score across ads and landing pages.

Your account is trying to compete everywhere and winning nowhere. Budget exhausts quickly while you’re still losing most auctions to competitors.

The Correct Action to Take

Tighten targeting before adjusting bids. Refine match types, add negative keywords, narrow geo-targeting, or adjust ad schedules to focus budget on high-intent searches. Improve ad copy and landing page relevance to boost Quality Score, then reassess whether bids need adjustment.

Scenario 4: When Budget and Rank Aren’t the Constraint

Conditions That Signal Other Bottlenecks

- Search Lost to Budget < 10%

- Search Lost to Rank < 20%

What This Means for Your Account

You’re showing up consistently for your target searches, but performance issues exist elsewhere. Bidding probably isn’t the bottleneck limiting results.

Your Search Impression Share is healthy, which means the problem is likely conversion rate, lead quality, creative performance, or targeting precision.

The Correct Action to Take

Focus on conversion rate optimization, lead quality analysis, query mining for negatives, and creative testing. Improving ad copy, landing pages, and offer clarity will likely produce better results than bid adjustments.

Why Offline Conversion Tracking Is Mandatory for Mid-Market Accounts

Offline conversion tracking connects ad clicks to actual closed deals, not just form submissions. Without it, bid decisions are based on lead volume instead of revenue—causing Google to optimize toward clicks and conversions that never turn into real business.

For mid-market Google Ads accounts, offline conversion tracking is what turns Search Impression Share into a usable bidding formula. It allows you to raise or lower bids with confidence, knowing which impressions and keywords actually produce profit.

Google states that by importing offline conversions, advertisers can measure what happens after an ad click or call in the offline world, such as closed deals or completed sales. This enables bid optimization around real business outcomes, not just on-site events like form fills.

This same principle applies across channels, whether you’re running paid search or paid social campaigns: if revenue isn’t being tracked, optimization will always be incomplete.

Benefits of Offline Conversion Tracking

When implemented correctly, offline conversion tracking delivers several advantages that directly improve bid efficiency, Search Impression Share, and overall ROI.

- Optimize for profit instead of activity: Google learns which impressions drive closed revenue, not just clicks or leads.

- Improve Search Impression Share efficiency: Budget and bids shift toward queries that actually convert, reducing wasted impressions.

- Separate qualified opportunities from spam and tire-kickers: Low-quality leads stop influencing bidding decisions.

- Stop bidding on traffic that never closes: Spend is automatically reduced on queries that generate clicks but no real business.

How Trustworthy Digital Applies This Framework in Real Campaigns

At Trustworthy Digital, we use Search Impression Share as the primary bid decision signal for mid-market Google Ads accounts managing five- and six-figure monthly budgets.

When Search Lost to Budget exceeds 50%, we reduce bids to lower CPCs and stretch spend across more qualified search volume. This allows accounts to maintain visibility throughout the day instead of exhausting budget early.

When Search Lost to Rank is the dominant constraint, we increase bids to reclaim impression share that competitors are capturing, provided offline conversion data confirms the demand is profitable.

This Google Ads bidding formula is applied consistently across all paid search campaigns we manage. Every account tracks offline conversions, ensuring bid changes are tied to closed revenue, not just form submissions or surface-level metrics.

How to Use This Framework Correctly

Check Search Impression Share at the campaign or keyword theme level, not blended across brand and non-brand campaigns. Use a consistent time window of 14 to 30 days for accurate trending. Confirm profitability with offline conversions before increasing bids or budgets, and watch marginal CPA or ROAS closely after making changes.

Frequently Asked Questions

How do you improve Search Impression Share?

Improve Search Impression Share by adjusting bids based on whether your account is limited by budget or rank. Search Lost to Budget over 50% is a red flag to consider reducing bids or increasing budget, while Search Lost to Rank over 50% signals potential bid increases, validated with offline conversion data.

How do you calculate Search Impression Share?

Search Impression Share is calculated by dividing the number of impressions your ads receive by the total number of impressions they were eligible to receive. Google calculates this automatically, but understanding the formula helps guide bid decisions.

What is Search Impression Share in Google Ads?

What is a good Search Impression Share?

How much should I bid on Google Ads?

How does offline conversion tracking improve Google Ads performance?

Ready to Stop Guessing in Google Ads?

If you’re managing a mid-market Google Ads budget and want bid decisions tied to real revenue, not vanity metrics, we can help.

We’ll review your Search Impression Share, identify whether budget or rank is limiting performance, and apply a proven bid decision framework to map the next bid changes, without guessing.

About the Author: Brandon O'Connor

Brandon founded Trustworthy Digital driven with a passion for transparent, data-driven marketing. Leveraging his extensive eCommerce and digital marketing expertise, Brandon guides the strategic direction, ensuring client success and ethical business practices are at the core of everything we do.

View all posts →